The Microfinancing Village Household and Loan Return: Do Credit Source, Education, Land Assets, and Gender Matter?

Disbursements of small-scale credit to poor entrepreneurial households in developing countries have become a popular tool for promoting self-sufficiency and alleviating poverty. The success of such programs, however, has been inconsistent across self-sufficiency and poverty measures. This study explores the effects of small-scale loans, household assets, and other household characteristics on household income. The study […]

Housing as a Social Determinant of Health: Implications for Rent Control Policy and Housing Shortage in Spokane

Demand for housing has increased throughout the nation as a result of a strong economy andrapid increases in population in some regions. The Pacific Northwest, particularly SpokaneCounty, has experienced significant increases in population growth as the region gains notorietyfor low building costs, housing affordability and medium-size city amenities. According to arecent report by real estate […]

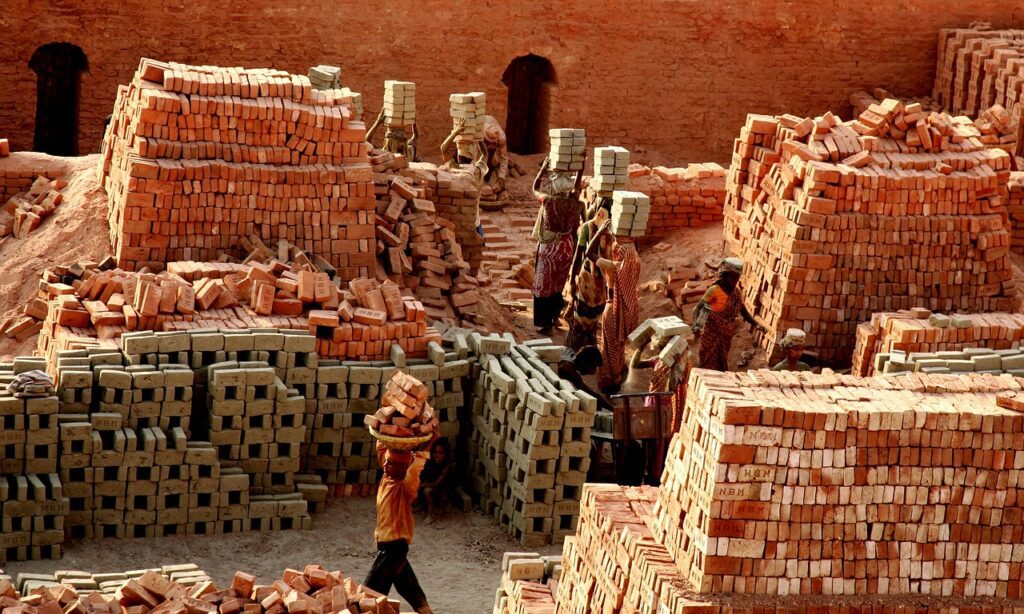

Human Development Approach to Sustainable Financial Inclusion: The Case of Microfinance in Rural Bangladesh

Human development typically refers to the set of opportunities that allow individuals to flourish in their lives. This study explores whether the provision of human development opportunities such as education and primary healthcare contributes to economic well-being among poor households who obtain microfinance loans. Using panel data from over 1,700 households in rural Bangladesh, this […]

Financing Village Enterprises in Rural Bangladesh: What Determines Non-Farm Revenue Growth?

The purpose of this paper is to explore the factors that determine non-farm enterprise revenue and to empirically test the association between access to credit, credit source and firm performance among poor entrepreneurs in rural Bangladesh. Design/methodology/approach Using a Bangladesh Institute of Development Studies and World Bank survey from over 1,700 households in rural Bangladesh, […]

Rural Finance Schemes Miss the Target: An Empirical Analysis of Gender and Social Inequality Effects

Using survey data from over 1,700 households in rural Bangladesh, this study explores whether access to credit has gender-specific impacts and whether this credit is associated with income distribution effects. To estimate these effects, a panel data model is used to explore the empirical association between access to credit, borrower gender and village income. Contrary […]